High conviction Portfolio

- Provides a deep understanding of opportunities for specific hedge fund strategies.

- Uses a thematic approach to assess opportunities from a bottom-up basis, providing a foundation for manager selection.

The CIBC Atlas Point Global Multi-Strategy Canada Fund is an alternative solution for accredited Canadian investors, that invests in the Atlas Point Global Multi-Strategy Offshore Fund. The fund will make opportunistic investments by taking a micro-thematic, bottom-up approach to identifying attractive, asymmetric return opportunities in assets and strategies that may not be easily captured through traditional investments.

Micro-thematic investing allots capital, over time, to opportunities that may be associated with long-term, structural trends. These thematic tailwinds are expected to dominate and drive performance.

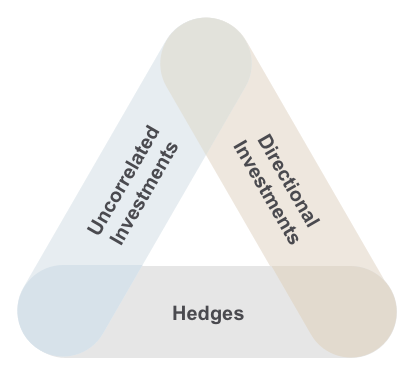

The underlying fund’s investment philosophy includes micro-themes that can be categorized into the three categories below:

refer to micro-thematic strategies based on a hedge fund manager’s outlook, supported by both qualitative and quantitative research.

are micro-thematic strategies that provide high quality diversification from traditional asset classes, given a manager’s distinct investment focus.

help minimize the portfolio’s overall downside risk, while limiting the portfolio concentration of each manager and micro-themes, helps bolster the fund’s overall risk management efficacy.

CIBC Atlas Point Global Multi-Strategy Canada Fund - Series F [Closed to all purchases]*

View Fund Details

Patrick Thillou

Vice-President, Structured Investments, Trading And Business Intiatives

Patrick Thillou is responsible for developing initiatives that improve and refine investment processes and infrastructure to support and monitor portfolio management activities. Additionally, Mr. Thillou is also responsible for the management of various structured, passive and overlay strategies and the oversight of trading activities for derivatives and for non-derivatives instruments.

Giuseppe Pietrantonio, CFA

Associate, Client Portfolio Manager - Multi-Asset & Currency Management

Giuseppe Pietrantonio is a member of the CIBC Client Portfolio Manager team. Mr. Pietrantonio partners with all CIBC distribution channels to deliver targeted thought leadership, education, and investment advice and perspective to clients and consultants.

Mr. Pietrantonio started his career with CIBC Asset Management in 2011. In his most recent position, he was a Manager on the Trading Systems team where he developed and implemented a currency management system. Prior to that, he held the positions of Portfolio Analyst and Corporate Actions Coordinator.

Mr. Pietrantonio holds a MBA degree and a BComm degree in Finance from Concordia University. He is also is a CFA charterholder and a member of the CFA Society of Montreal.

Ohm Srinivasan, CFA

Managing Director, Co-Manager, Hedge Funds

Jigar Patel, CFA

Managing Director, Co-Manager, Hedge Funds

Jigar Patel is an investment portfolio manager and co-heads the hedge fund research efforts within the Multi-Manager Investment Program (MMIP) based in New York. He is responsible for managing the MMIP hedge fund platform, which includes an internal multi-strategy fund of funds portfolio and a customized hedge.

The underlying fund’s micro-thematic approach coupled with an opportunistic investing methodology is a key contributor towards the fund’s performance.

The focus of the manager of the underlying fund is on identifying a relatively concentrated set of micro-themes, then allocating to them through a limited set of specialist managers is the fund’s primary source of value-add

The manager of the underlying fund’s investment approach maximizes potential success by executing in a disciplined manner. The manager avoids chasing performance, as past performance has been a poor indicator of future success.

At CIBC Asset Management, we believe every customized investment solution begins with research and rigour. We specialize in a variety of investment solutions such as equities, fixed income, currency management, liability-driven investments, asset allocation and responsible investments.

Across a spectrum of investment solutions, we commit to robust research. Dedicated sector and regional analysts focus on industry research and security-specific idea generation. Our investment professionals leverage deep and diverse expertise by sharing proprietary research across asset class teams. By sharing insight across asset class teams, we maximize opportunities to add value to our client portfolios.

*Effective December 20, 2024, the Fund is no longer available for new purchases and is expected to be terminated on or about June 3, 2025.

This material is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to.

The fund is a prospectus exempt fund and is not subject to the same regulatory requirements as publicly offered investment funds offered by way of prospectus.

This material does not form part of an offering document and does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities of the fund. Any such offer or solicitation may only be made through, and in accordance with, the terms of the subscription agreement and confidential offering memorandum of the fund (collectively, the “Offering Document”), and the constating documents of the fund.

Any information or discussion about the current characteristics of this fund or how the portfolio manager is managing the fund is not a discussion about material investment objectives or strategies, but solely a discussion of the current characteristics or manner of fulfilling the investment objectives and strategies, and is subject to change without notice.

Past performance may not be repeated.

The material and/or its contents may not be reproduced without the express written consent of CIBC Asset Management Inc.